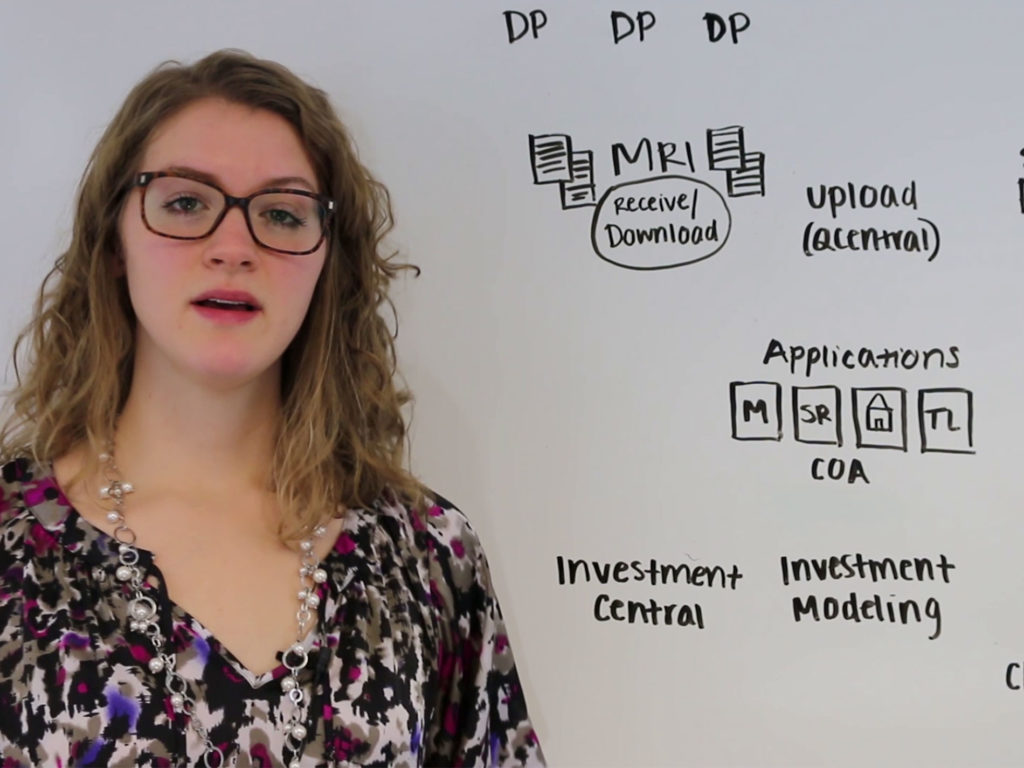

On this week’s Whiteboard Wednesday, MRI Software’s Eva Chamberlain discusses the data processing process within MRI Softwares’s Data Management Services. Eva will cover the step-by-step process that allows MRI Software’s proprietary systems and analysts to turn messy, disparate data into meaningful real estate investment data for our clients.

Tune in every Wednesday for a new edition of Whiteboard Wednesday, and be sure to hit subscribe to catch this series — and all of our other real estate software related content.

Video Trancription

Eva Chamberlain: Hi, I’m Eva Chamberlain. On today’s Whiteboard Wednesday, we’ll be discussing data processing within the MRI data management services. The first step in any data processing is receiving the files. These files can come in any format, Excel, PDF, Word, or even text, although we definitely prefer Excel. These data providers can be anybody, from borrowers to auditors, to tax return preparers, to our client, to accountants, to anybody related to any property or fund. Once we receive and download the documents, they’re uploaded into our proprietary software called Q-Central.

Q-Central allows our analysts to manage the data workload and also load the data directly from the files into our SQL databases. Before we can load the data into the databases, we need to prepare the Excel files and the PDF files and the Word files and even the text files into a standard format. We call this ABC in reference to ABC and Excel. Once these files are in a standard format, we run them through our applications. Our applications can be the mapper, statement review, occupancy loader, or even tax loader. These applications are directly connected to our SQL databases.

Whatever we load through here is what our client will see. Now, at this point in the process, we standardize the chart of accounts. When we receive so many files from all the data providers, there are so many thousands of charts of accounts that we have to manage. At this point, we simplify into one chart of accounts. Our client then can then see their financials for any investments simplified into one format. From the applications, the data is directly loaded into database, it turns into SQL data. At this point, we can turn it into reports for our clients in several different ways. We can upload it into our customized client site called Investment Central. We can upload it into Investment Modeling, which is more about forecasting.

Then the last thing we can do is we can export the data to our clients. Now, we can export it directly to our client, or we can directly export it to a third-party software, or whatever the client chooses. At this point, the client can understand and they can see their data. They can make changes or anything that they may want to do, to manage their investments properly. That’s it for today’s Whiteboard Wednesday. Make sure to like, comment or subscribe.