APAC’s Workspace Transformation: Exploring regional trends from MRI’s recent report

The dynamics of workspace utilisation have evolved dramatically over the past few years.

To better understand the evolving state of the workplace, MRI Software recently partnered with CoreNet Global to gain insights from real estate occupiers. Since its inception in 2021, the report has gathered responses from the global occupier sector using a standardised set of questions. This approach offers a valuable means of assessing market sentiment and monitoring trends over an extended period.

Market Insights: Evolution of the Workplace

Analyzing trends for real estate occupiers from 2021–2023.

The recently launched 2023 version highlighted a number of intriguing insight shifts, in particular, the changing preferences of businesses towards leasing and utilising spaces. In this blog, I’ll take a closer look at a couple of key insights from the report, specifically focusing on their relevance and implications within the APAC region.

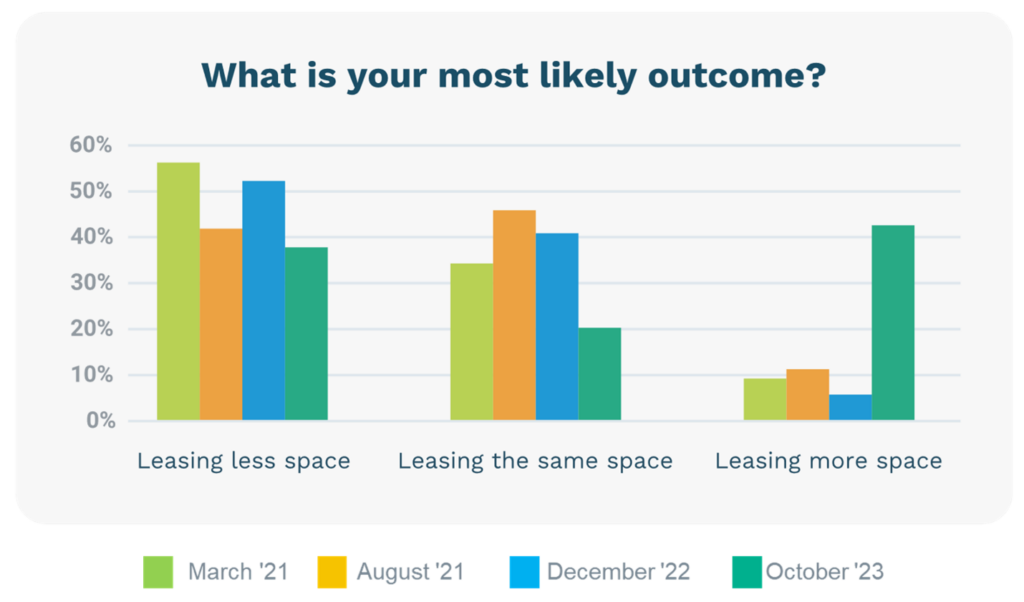

The Return to More Space

For the first time since 2021, respondents have indicated a desire to add more space. With more people returning to offices, less density and more collaborative spaces seem to be the desired outcome for teams.

In Australia and New Zealand, we are seeing this shift occur due to a couple of factors:

- Retail Repositioning: Retail spaces are transforming into entertainment hubs to attract and retain customers. For instance, Westfield Knox in Melbourne is currently undergoing a $355M+ upgrade to include a basketball court, public library, and co-working facilities[1].

- Industrial Expansion: The boom in e-commerce remains a driving force behind the expansion of industrial spaces, leading to the increased necessity for spaces to access changing consumer demands and streamline logistical operations.

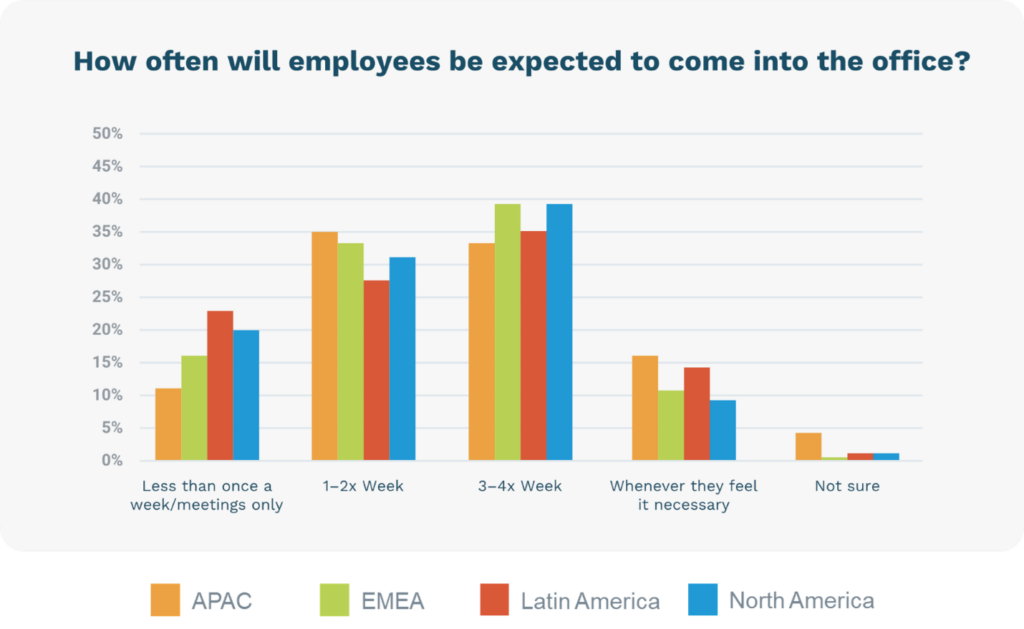

The Rise of Return-to-Office Policies

The survey revealed a significant spike in companies updating their return-to-office (RTO) policies. Interestingly, only 64% of APAC respondents stated that their company had an RTO policy, compared to 91% in EMEA and 89% in North America.

One reason we may be seeing a slower uptake of RTO policies in the region is because Australia has some of the strongest work-from-home rights in the world. There have been a couple of examples indicating this strength, including a recent deal that was struck by the public sector union, allowing Australia’s 120,000 federal employees to request to work-from-home for an unlimited number of days.[2]

Despite this, RTO policies globally have been on the rise over the last year for a number of reasons, including the benefits of connection, collaboration and managing work-life boundaries. As such, businesses are looking at new ways to adapt their workplaces to meet both organisational objectives and the diverse needs of their employees within it.

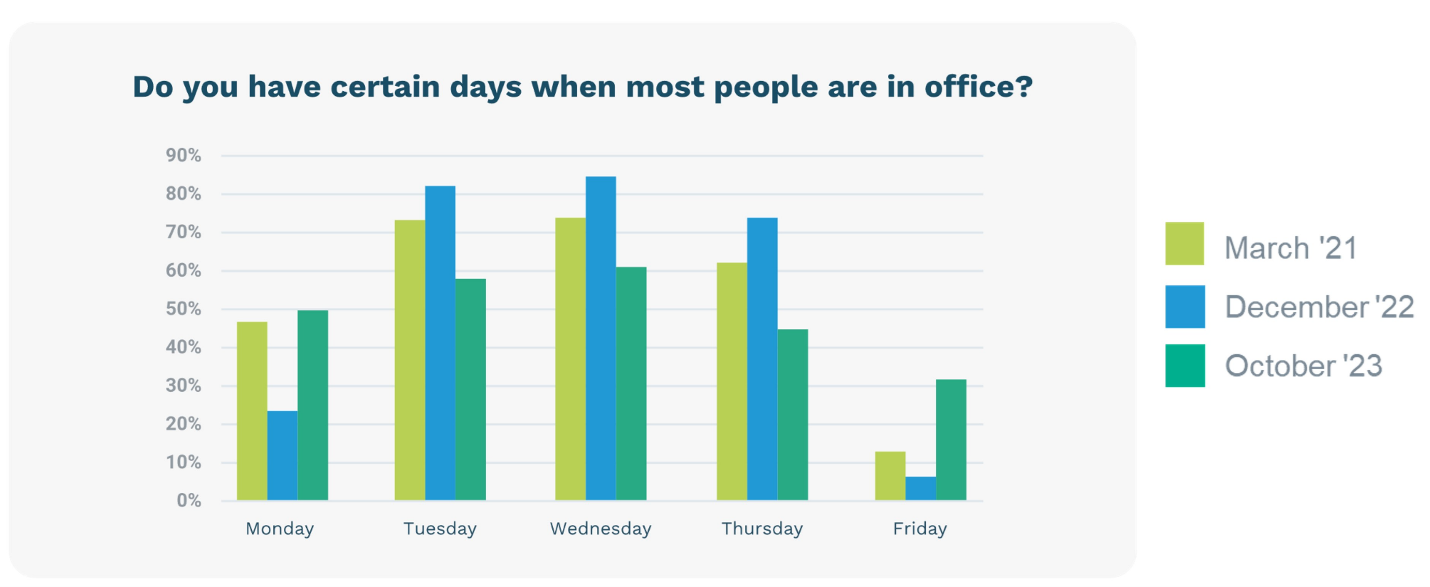

Diversified in-office schedules

Over the past year, there’s been a noticeable shift in in-office work schedules. Particularly, when it comes to employees opting to work on Mondays and Fridays, with both days experiencing a rise of over 20% since December 2022. While there has been an increase, the start and end of the workweek are still lagging, as Tuesday through to Thursday continues to bring in larger numbers of office attendance.

So, why is this shift happening? A few reasons could be at play.

- Meeting new RTO policies: While there appears to be a lower number of companies in APAC adopting RTO policies, we are still seeing 30% of those that have them in place, requiring employees in-office 3-4 times a week. With more companies requiring greater in-office attendance, this could explain the Monday and Friday rise.

- Encouraging office return: A recent Australian study conducted by the University of Sydney in September 2023 aligns with these current trends, showing that more Australians are opting to be in the office on Thursdays and Fridays[3]. Professionals and sales workers are driving this increase, making up 37% of the workforce. The research also suggests that the preference for office attendance on Fridays may be linked to social activities that offer employees more opportunities to connect in-person on these historically quieter in-office days.

The workspace landscape is continually evolving, with organisations adapting to economic conditions, employee preferences, and business needs. It will be interesting to see how these trends continue to develop in the coming years.

To further explore the workspace trends in the APAC region, download the full report by MRI Software and CoreNet Global.

Sources:

[1] https://www.scentregroup.com/our-customers/westfield-destinations/westfield-knox

[2] https://www.news.com.au/finance/work/at-work/public-service-staff-secure-unlimited-workfromhome-days/news-story/a517f1547947324a24b95eec0087891c

[3] University of Sydney’s Institute of Transport and Logistics Studies

CoreNet 2024 Global Leasing Trends Report

MRI Software partnered with CoreNet Global to uncover 2024 real estate occupier leasing trends and provide critical insights to guide you through the current and future state of CRE leasing. Building on previous surveys, the report analyses data from…