IFRS 16 – Knowing your Leases 101

Welcome to the first in our series of IFRS 16 ‘101’ blogs, aimed at guiding you through the preparation required to successfully transition to IFRS 16 lease accounting in time for 1st April 2022.

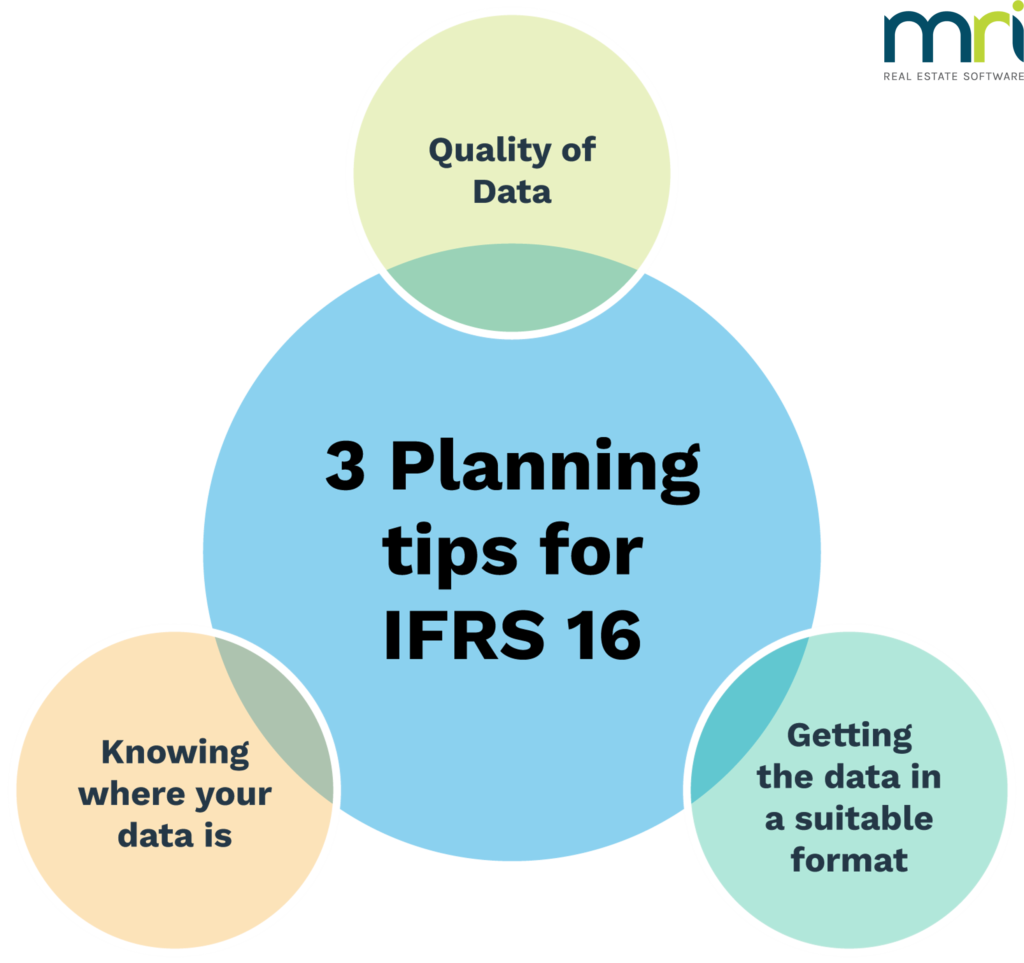

In this blog, we will focus on the importance of extracting, collating, and analysing your lease data and how this initial step in the process will set you up for success.

Knowing where your data is

The first thing to consider, and what is often the biggest burden when preparing for IFRS 16, is knowing where your lease data resides. Reliable lease data is essential in meeting IFRS 16 reporting requirements and without it, you will simply not be able to comply.

It can often take weeks, or potentially months to collate, so it is vital to know where your leases are located as early as possible to build the foundations of a successful transition. In our experience, MRI has found that lease data is typically dispersed, whether that be across departments and entities or simply from a location perspective i.e., Stored in various software applications or in filing cabinets in a physical office.

Having worked with several organisations, the reality can be somewhat different to initial expectations. As an example, a recent client believed that its IFRS 16 transition would be quick and easy, only having to convert a couple of dozen leases. However, when it started to uncover its leases, it quickly realised that its portfolio was a lot more complex, with embedded leases, high volumes of equipment and the need to account for subleases. It then began to categorise and proactively collate based on asset class with lease types such as property leases, land leases, equipment leases, vehicle leases to name a few, which transpired in bringing hundreds of leases onto the balance sheet to comply with the new IFRS 16 standard.

Quality of data

Finding out where your lease data is located is only the start. The next step is assessing the quality of the data both in terms of completeness and accuracy. In our experience, lease data quality is often poor when held in high-risk, non-auditable applications such as spreadsheets. Organisations frequently believe themselves to be ahead of the curve and in an advantageous position, however when digging into the data, information gaps and inaccuracies can become apparent and so begins a lengthy exercise to cleanse the data, reverting right back to the lease documentation.

Having comprehensive information is crucial. We find so often that organisations are focused completely on rent values and payment frequency for example, but then must search, find, and enrich the data to include any lease incentives (capital contributions) or costs (ie: legal fees).

Getting the data in a suitable format

Once the data has been located, assessed, and cleansed, the next stage of ‘knowing your leases’ is getting the lease data in the correct format to maximise the accuracy of the accounting calculations and ready to produce the lease accounting schedules necessary for compliance reporting.

Whichever technology platform your organisation chooses, it needs to be robust, it needs to be able to handle the ever growing and evolving nature of your portfolio requirements, and it needs to facilitate cross departmental collaboration as the property and lease managers liaise with the lease accounting and finance teams. This is not just a standard that impacts finance, this is a fundamental change to the way your organisation manages and treats leases. Therefore, it is crucial that you have all lease data at a click of a button, accurate and in a suitable format to produce these outputs.

To learn more about our lease management solutions and how you can get everything in order for your IFRS 16 requirements, book a free demo below.

Software solutions and services for workplace management, lease administration and lease accounting.Workplace

CoreNet 2024 Global Leasing Trends Report

MRI Software partnered with CoreNet Global to uncover 2024 real estate occupier leasing trends and provide critical insights to guide you through the current and future state of CRE leasing. Building on previous surveys, the report analyses data from…