Finding the right lease accounting solution for the transition

Welcome back to our series of IFRS 16 ‘101’ blogs, aimed at guiding you through the preparation required to successfully transition to a IFRS 16 lease accounting solution in time for 1st April 2022.

Now that you have collated all your lease data and put it into a suitable format you now need to procure an appropriate system. To do this, there are a few key elements that need to be considered and that is what we are going to be focusing on here in the second blog post.

Understanding your complexities and requirements

Here at MRI, we understand that there is a vast array of solutions in the market that can assist with the IFRS 16 transition and so deciding which vendor to go for can become quite a lengthy and challenging process. However, it is only when we start to dig deeper into the nuances of the portfolio and requirements that we can begin to understand which system will be the most suitable not only for the immediate transition on April 1st but also continuing for the years to come.

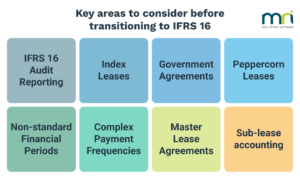

Some key areas to think about are:

- IFRS 16 audit reporting – the ability to audit your disclosure reporting is a requirement.

- Index leases

- Government Agreements – where there is not a legally enforceable agreement, but it is defined under IFRS 16 for the public sector.

- Peppercorn leases – leases for which the consideration paid is nil or nominal.

- Non-standard financial periods – anything other than calendar month.

- Complex payment frequencies

- Master lease agreements – for vehicles and equipment leases.

- Sub-lease accounting

These may not be things you have thought about so beginning to understand these early in the process is key as it shapes how you approach this process.

What this will look like for your organisation

Another factor that needs to be taken into consideration is the functions that are involved. Of course, the finance team will be influential in running the IFRS 16 calculations but what about other departments? The property team, for example, may not seem like a necessary party to bring in here but what needs to be remembered is that the data needed for IFRS 16 reporting comes directly from this team.

From our years of experience handling hundreds of IFRS 16 transitions in both the private and the public sector we have seen first-hand how important it is to have cross-departmental collaboration throughout the entire process. A trend we have noticed is that those that continue to adopt a siloed approach have difficulties when it comes to reporting due to delays and inaccuracies in the data.

Having an IFRS 16 software system that can facilitate this will put you in a great position to maintain compliance with the new lease accounting standards. The data on which the finance team is reporting is the exact same data that the property/estates/asset team(s) have been inputting, tracking, and managing on a daily basis, meaning you can be confident that the calculations are accurate and reliable for IFRS 16 reporting.

Whichever solution you pick needs to be able to handle all the complexities your portfolio may have. as well as allow for streamlined collaboration across the organisation – only then can you be fully prepared for the upcoming transition.

To learn more about how technology can help you prepare for the IFRS 16 lease accounting transition, book a free demo below.

Software solutions and services for workplace management, lease administration and lease accounting.Workplace

CoreNet 2024 Global Leasing Trends Report

MRI Software partnered with CoreNet Global to uncover 2024 real estate occupier leasing trends and provide critical insights to guide you through the current and future state of CRE leasing. Building on previous surveys, the report analyses data from…