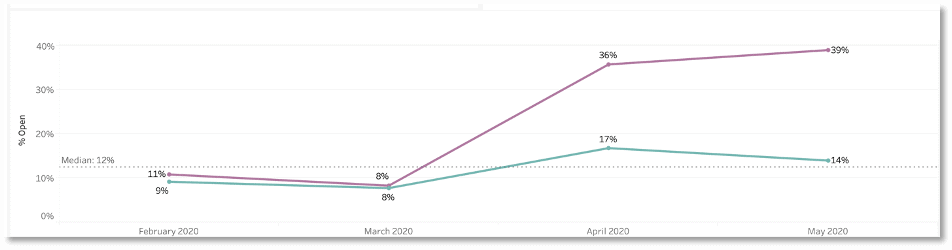

Open rent receivables in commercial real estate: retail vs non-retail

In March 2020, the COVID-19 pandemic initiated a period of uncertainty for the global economy, and the commercial real estate sector was no exception. Many office workers quickly shifted to remote-working scenarios, while retail businesses and restaurants instituted temporary closures.

In April 2020, MRI Software compiled data from a subset of commercial and retail users of our property management software to gain a better understanding of the impact on the sector. Within this pool, we discovered that 27% of commercial tenants didn’t pay their April base rent. This was almost three times higher than February’s pre-COVID numbers, when 10% of tenants did not pay their rent.

As May closed, we decided to look at open rents by NAICS category to see which types of businesses were having the most trouble paying their rent. We explored approximately 20 different NAICS categories between February and May, with the assumption that the retail sector was presumably the hardest hit.

Comparing commercial retail properties with non-retail

We see a major difference between leases in retail-only properties and those in other types of properties. Retail-only portfolios have an open rent average of 39% for May, whereas non-retail properties are at 14%.

Within retail trade, the categories with the highest open rent rates include Clothing and Clothing Accessory Stores (80%), Furniture and Home Furnishings (83%), Shoe Stores (85%), and Luxury (94%). These areas, while struggling, only represent a small portion of the total value of the Retail Trade category. Mid-tier pressure points include Florists, Sporting Goods, Hobby, and Musical Instruments (62%), Specialty Food (45%), and General Merchandise (40%). These by nature are broad categories and make up about 25% of the leases in the overall Retail Trade category in our data set.

However, we see open receivables for Grocery (4%), Building Materials (2%), and Gasoline Stations (5%) in line with pre-COVID numbers. Grocery stores are not surprising, and the high rate of payments for gas stations could be because their grocery sales are offsetting their losses. Companies that sell building materials could be positively affected by the rise in household improvement projects being taken on by people who are spending more time at home.

What happens next?

It’s no surprise that retail tenants are more affected by the pandemic than office tenants, many of whose employees can work from home. As lockdowns are lifted and businesses reopen, we hope to see some improvement in payment rates among retail tenants.

But landlords and tenants may still need to work together to develop flexible payment plans to benefit both parties in the long-term. In the month of May, many businesses may have benefitted from government programs such as Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) or figured out other ways to ensure business continuity. When these safety nets are removed, decisions regarding expenses, cashflow, and operating costs can no longer be delayed. Both landlords and tenants need to mitigate the business risk of COVID-19, and working together to reach mutually beneficial agreements will be in the best interest of both parties.

Make Smarter Decisions with AI-Powered Business Intelligence

Explore how Business Intelligence (BI) and data management can revolutionize decision-making in the real estate industry. This webinar features industry experts, including Andy Birch, VP at MRI Software, Justin Manning, Senior Specialist at Microsoft…