Exploring alternative real estate investments: New opportunities beyond traditional assets

Real estate has long been a cornerstone of wealth-building, but traditional options like rental properties or standard REITs don’t always offer the flexibility or returns that modern investors want. In recent years, alternative real estate investments have emerged as a powerful way to diversify portfolios and tap growing markets. These options go beyond the usual holdings, providing unique opportunities to grow wealth while adapting to shifting trends.

This guide explores what makes a real estate investment “alternative” and breaks down key asset classes like student housing, data centers, and sustainable buildings. You’ll also discover the advantages of these investments, from potential higher returns to risk mitigation strategies. You’ll get actionable insights that help you confidently expand your portfolio.

What makes a real estate investment “alternative?”

Alternative investments go beyond conventional property ownership, focusing on unique markets or funding methods. They include sectors like co-working spaces, sustainable buildings, and self-storage, which cater to specific trends or demands. By tapping into these alternative asset classes of real estate opportunities, investors can access income streams that aren’t as tied to traditional economic cycles.

Unlike traditional real estate, many alternative investments are managed through specialized funds or partnerships, reducing the hands-on work required by investors. This structure makes them particularly appealing to landlords with large portfolios who are seeking scalable opportunities. The flexibility and innovation of these investments also enable you to adapt quickly to changing market conditions.

Examples of alternative real estate asset classes

Alternative real estate investments offer a wide variety of asset classes, each providing unique opportunities to diversify your portfolio. From student housing to sustainable buildings, these sectors cater to specific market needs and trends. Here are some of the most promising alternative real estate asset classes gaining traction today.

Real estate investment trusts (REITs)

REITs provide an easy way to invest in real estate without the complexities of owning property directly. These trusts let you buy shares in income-generating properties, which are managed by professionals and traded on stock exchanges. What is a real estate investment trust (REIT)? It’s essentially a vehicle that lets you invest in a diversified pool of real estate assets without direct ownership.

Industrial properties

The surge in e-commerce has driven unprecedented demand for industrial spaces like warehouses and logistics centers. Long-term leases with stable tenants make these properties a consistent income source. Industrial real estate in North America has seen double-digit growth since 2020, fueled by increasing consumer reliance on online shopping.

Student housing

Student housing is another resilient asset class, often thriving even during economic downturns. The growing demand for higher education worldwide, particularly in the U.S. and U.K., drives consistent rental income. Investing in properties near tier-1 universities ensures steady occupancy rates, often backed by diverse student demographics.

Self-storage

Self-storage facilities have become indispensable as urban populations grow and living spaces shrink. These properties cater to peopleneeding extra space and businesses requiring flexible storage solutions. The self-storage sector is also expanding into niches like climate-controlled units for wine or specialized spaces for e-commerce inventory.

Distressed assets

Distressed properties offer significant potential for high returns, especially when acquired during economic downturns. These assets are typically sold below market value due to financial challenges, providing opportunities for renovation and repositioning. However, successful investing in this sector requires thorough due diligence and expertise in asset recovery.

Green buildings and sustainable properties

Green buildings combine environmental responsibility with financial benefits, offering energy-efficient designs and sustainable materials. These properties appeal to tenants and investors alike, aligning with global trends toward eco-consciousness. Investing in sustainable real estate can enhance your portfolio while supporting long-term environmental goals.

Why invest in alternative real estate?

Investing in alternative investments opens the door to exciting opportunities for diversification and growth. These investments often have lower correlations with traditional markets, helping reduce overall portfolio risk. They also align with emerging trends, offering the potential for higher returns and access to sectors with long-term growth prospects.

Diversification and risk mitigation

These investments often have lower correlations to traditional market cycles, helping balance risk in your portfolio. Sectors like senior housing are driven by demographic trends rather than economic fluctuations. This makes them a valuable addition to a diversified real estate investment portfolio, providing stability during volatile financial periods.

Potential higher returns

Many alternative investments, like student housing or data centers, have the potential for higher yields compared to traditional real estate. Data centers, for example , are growing exponentially due to the rise of AI, cloud computing, and IoT. By targeting these high-demand markets, investors can unlock significant income potential.

Growing demand and market potential

Emerging sectors like cold storage and sustainable buildings are poised for long-term growth as consumer preferences evolve. Cold storage, for example, has seen a surge in demand due to grocery delivery services and global trade in perishable goods. Investing in these sectors early positions you to benefit from sustained market expansion.

Key considerations before investing in alternative real estate

Investing in other real estate requires careful planning and a clear understanding of the risks involved. These investments often demand thorough research, from assessing liquidity to evaluating long-term growth potential. By focusing on these key factors, you can make smarter decisions and ensure your strategy aligns with your financial goals.

Assessing risk and liquidity

Liquidity varies widely across alternative asset classes, and some investments require long-term commitments. REITs offer easy liquidity, while distressed assets may take years to sell or redevelop. It’s crucial to understand your liquidity needs and align them with your investment goals.

Due diligence and research

Thorough due diligence is critical for evaluating the viability of real estate investments. This includes assessing market demand, sponsor credibility, and projected returns. Before investing in student housing, research the university’s enrollment growth and local housing shortages to gauge the potential for long-term income.

Long-term potential and investment horizon

Alternative investments often take time to realize their full value, requiring a long-term outlook. Green buildings, for example, may have higher upfront costs but offer substantial savings and asset appreciation over time. Aligning your investment horizon with your financial goals ensures you maximize the benefits of these opportunities.

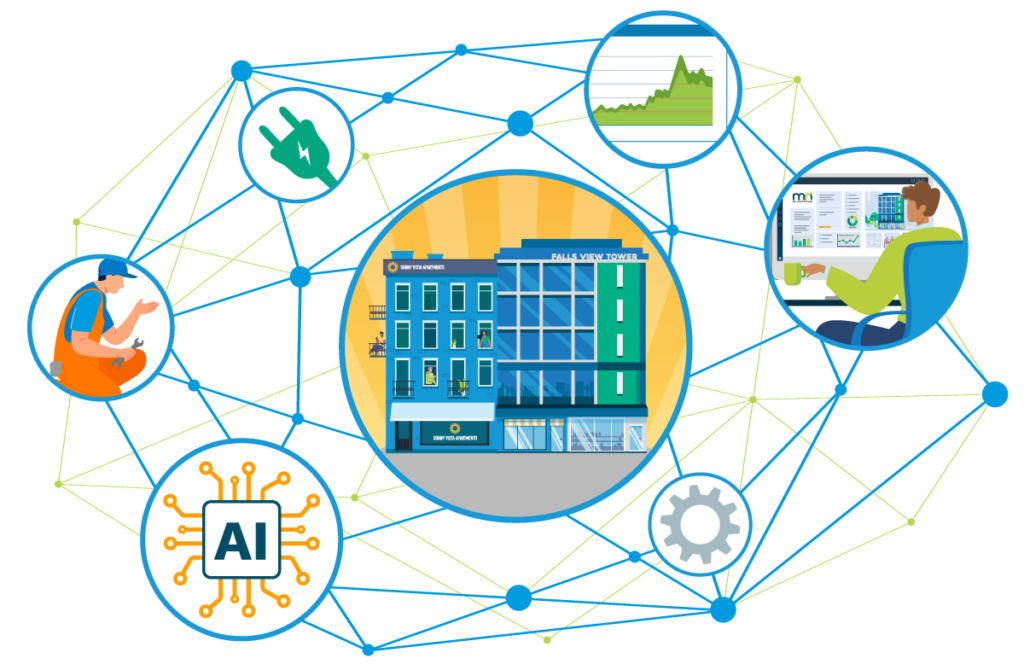

Empowering landlords with smarter tools for alternative real estate

At MRI Software, we understand the complexities of managing real estate investments. That’s why our property investment software is designed to streamline operations, automate rent collection, and provide valuable insights tailored to your unique portfolio. Whether you’re overseeing self-storage units, green buildings, or student housing, MRI equips you with the technology to scale efficiently and stay ahead of market trends.

Investment Tech Buyer's Guide

Reduce risk and ensure investor satisfaction with investment management for real estate

AI’s Impact on Real Estate: 8 Experts, 8 Real Scenarios

Artificial intelligence is transforming corporate real estate, streamlining operations, reducing costs, and driving smarter decision-making. In this on-demand webinar, we go beyond the hype to showcase eight real-world scenarios where AI is making a …