2025 Interest Rates: How PropTech supports real estate investment in an uncertain environment

**Updated December 2024**

While interest rate cuts finally came at the end of 2024, the rates themselves are still high compared to previous years – and while some additional cuts are anticipated in 2025, it’s unlikely we will get close to pre-pandemic lows. How can you strengthen your real estate portfolio while it’s still expensive to borrow capital for new deals? Learn how advanced PropTech solutions help you closely monitor and manage your portfolio to uncover efficiencies and unlock hidden value during this time of economic uncertainty.

The economic “state of flux”

After a long period of fighting inflation with the most restrictive monetary policy in 40 years, the Federal Open Market Committee (FOMC) began reducing interest rates in September to the current range of 4.5–4.75% (down from 5.25–5.50%). The economy is closing in on a 2% inflation rate of Personal Consumption Expenditures (PCE), which is the committee’s preferred inflation gauge. Further cuts are expected, but interest rates are still high compared to their pre-pandemic lows.

While the economic “soft landing” is good news, there is still much uncertainty in the air – and that means continuing risks for real estate investing. Disconnects between improving macroeconomic trends and rising costs for individuals fueled the recent US election, and the incoming administration wants to act quickly. Real estate investors can expect rapid shifts in economic policies and regulations that will affect everything from salaries and employment to supply chains and business costs – all of which can affect investments positively and negatively.

Where does real estate investment stand now? It’s in a state of flux. While interest rate volatility is down, the unknown effects of a new administration, changing economic policies, and potential industry deregulation make for an uncertain economy. Conditions aren’t completely predictable, so real estate organizations will need to build strategies around areas where they are confident while being prepared for any number of variables. For example, firms don’t have to plan for interest rate increases for now, so they can calculate their maximum interest expense. However, the unknown economic factors could mean the difference between smaller returns and tanking an entire investment.

PropTech’s role in overcoming economic uncertainty

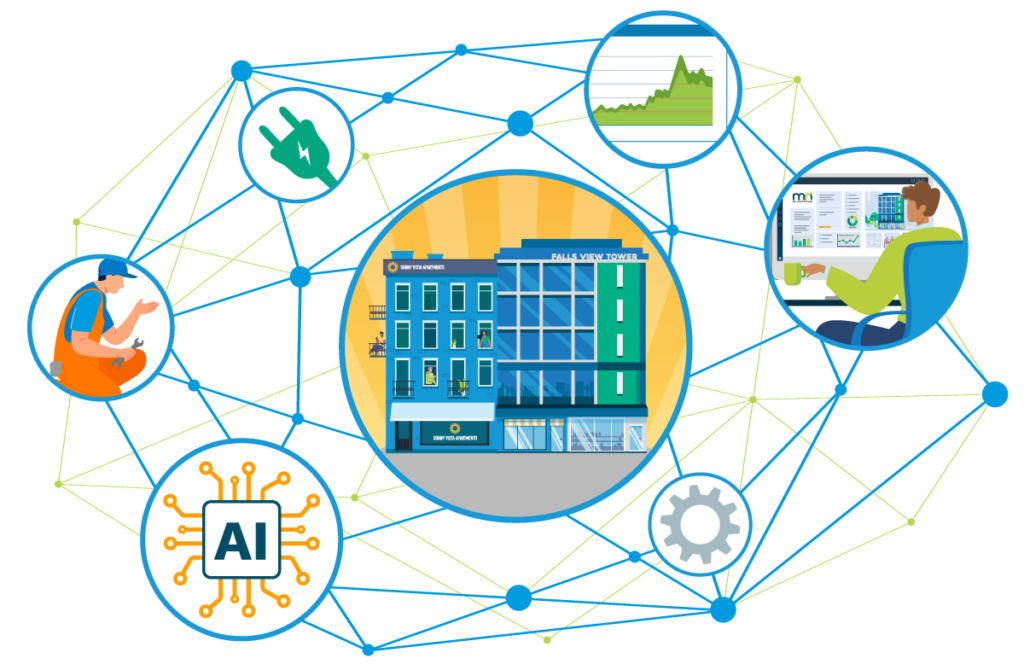

With the economic future unclear, what can real estate investment firms do to navigate the uncertainty? PropTech solutions are one path forward, helping portfolio managers closely monitor and manage assets through uncertain times. Specific fiscal policy plans and decisions won’t be known until around Q2, so firms must account for any number of outcomes in the months ahead. The right automation and strategies can help firms test assumptions, strengthen decision making and boost investor confidence and retention, keeping portfolios well-positioned as the economy and the real estate market evolve.

More accurate scenario forecasting and testing

The biggest challenge for portfolio managers is predicting how changing conditions will affect their decisions on refinancing, selling, or buying an asset. With the unclear picture of how interest rates will be affected by new economic policies, real estate investment firms must develop portfolio strategies for multiple scenarios.

Planning across factors

Portfolio managers face plenty of unknowns, including how interest rate volatility can affect other economic factors (such as tenants’ ability to pay rent). They must consider increasing capitalization rates in certain segments, the growth of alternative funding sources like private lending, and how unemployment rates will increase operational costs. Firms must also carefully plan and budget for how debt will shape future strategies. This evolving environment requires even more detailed analysis, due diligence, and investor scrutiny than ever before to ensure maximum ROI and revenue.

Fortunately, testing the many variables in play doesn’t have to get in the way of timely decision making in a dynamic market. Advanced technology solutions help investment firms understand their portfolios’ sensitivity to market fluctuations across a broad range of factors and build multiple plans quickly based on different scenarios.

Forward-thinking organizations can use asset modelling to test different scenarios and analyze the effects on asset performance and valuation across their portfolio. If the market continues in a falling-but-high interest rate scenario through 2025, portfolio managers can uncover efficiencies at the asset level to squeeze more value out of their current holdings. If more drastic interest rate reductions happen, managers must be prepared to have assets ready for more buyers re-entering the market.

Analysis timing

Another important factor in portfolio success is the frequency of interest rate scenario analysis. Traditionally, real estate organizations test the effects of different interest rates only when considering whether to buy, sell, or refinance an asset. The current economic uncertainty means portfolio managers must keep a much closer eye on fiscal policies and real estate market conditions. The most successful managers won’t wait until the end of an asset’s lifecycle before testing interest rate scenarios. Frequent analysis across multiple factors will prepare organizations for different market and interest rate possibilities – and help them avoid letting new opportunities pass by.

The need for dedicated solutions

In any scenario, organizations can use advanced PropTech to gain a competitive edge. A dedicated asset modelling solution can make forecasts across this breadth of economic and market factors. The calculations are simply too complex for a simple Excel spreadsheet to handle accurately and quickly. What’s more, asset modelling software is more intuitive than working in a spreadsheet, helping portfolio managers conduct deeper analysis across more factors and asset relationships.

It’s also important not to overlook data quality. While many organizations have a wealth of historical data for asset management, economic uncertainty requires more up-to-date information. Open and connected real estate investment solutions like MRI Investment Central can connect multiple data sources (including third-party sources) across your portfolio, making it easier to combine asset, market, and economic data to facilitate strategic analysis. The combination of historical precedent and current data provides a stronger analytical foundation.

Stronger transparency and investor confidence

Commercial real estate experts at MRI Software have spoken with many CFOs about their insights into the uncertain environment. A recurring theme is that while debt financing in this economy raises many challenges and concerns, it’s more difficult to secure new capital from investors. Historically stable and reliable core asset classes are suffering major vacancies and declining market values. With investors facing an unpredictable future, many are turning to alternative investments that promise greater – and potentially more predictable – returns.

What can portfolio and fund managers do to guide investors back to real estate assets? While offering strong returns is important, it’s not the only thing investors care about. In the face of economic uncertainty, investors want to be confident in the actions taken by the organizations they entrust with their money. Organizations can strengthen that trust by sharing visibility into the tactics and strategies and ensure their assets are positioned for higher returns once the next cyclical upswing begins.

Again, the right technology is critical. An effective investment tech stack should not only deliver accurate forecasts, but also provide a platform for communicating with investors and offering transparency into portfolio strategies. The platform should incorporate real-time portfolio and market data to generate robust reporting. It should also have an intuitive interface and dashboards so investors can quickly understand the effects of future changes on their investments. Consistent, frequent communication is also key, so the platform should let portfolio managers automate the sharing of news and regular updates with investors and stakeholders. Making all this information easily accessible helps organizations ensure no one is ever left in the dark.

For example, MRI Investor Connect acts as a hub for aggregating and reporting on asset and portfolio data. The solution can import and centralize data across multiple sources, warehouses and systems. It increases transparency for users by including granular and contextual data (such as occupancy rates) that influence individual asset valuations and drive overall portfolio performance. This data can then be summarized in intuitive visualizations, dashboards, and reports. Portfolio managers, investors, and other stakeholders (such as lenders and brokers) can continuously track and monitor KPIs, get a more accurate picture of portfolio performance, and stay informed about the organization’s strategic decisions.

Communication tools are also useful for reassuring investors who evaluate specific environmental and social criteria for where – and with whom – they invest their money. In an economic climate where investors are considering non-real estate options to meet their objectives, institutional real estate investment firms must take the necessary steps to meet ESG criteria and open themselves to additional capital investment. Having the technology to not only achieve ESG targets and objectives, but also communicate progress and results to a broad audience, will help companies set themselves apart.

Strong ROI: The value of investment PropTech

Moving through and beyond the current environment, the most successful organizations will be able to easily pivot strategies and deploy capital quickly to take advantage of opportunities. That flexibility will keep their overall portfolios resilient and insulated from economic turmoil that impacts specific asset classes or regions. Advanced technology will help visionary portfolio managers test different approaches quickly and reshape their portfolio mix to maintain growth. The key is investing in those systems and processes now before interest rates change again.

The right tech presents an opportunity for significant revenue growth, helping firms deliver the ROI needed to justify the business case for implementation. More importantly, newer platforms incorporate the latest advancements in artificial intelligence, which is proliferating quickly throughout the PropTech world. AI’s ability to automate mundane, time-consuming tasks will help organizations significantly reduce operational expenses and minimize (or avoid entirely) onboarding new staff. AI also frees roles at all levels to focus on spearheading strategies that will propel your business despite market headwinds.

No matter what developments happen in the coming months and years, PropTech developed specifically for real estate investment will help organizations respond more quickly to market changes and maximize ROI for their investors.

AI’s Impact on Real Estate: 8 Experts, 8 Real Scenarios

Artificial intelligence is transforming corporate real estate, streamlining operations, reducing costs, and driving smarter decision-making. In this on-demand webinar, we go beyond the hype to showcase eight real-world scenarios where AI is making a …